27 October 2022 | Climate Tech

Metals on the mind

By

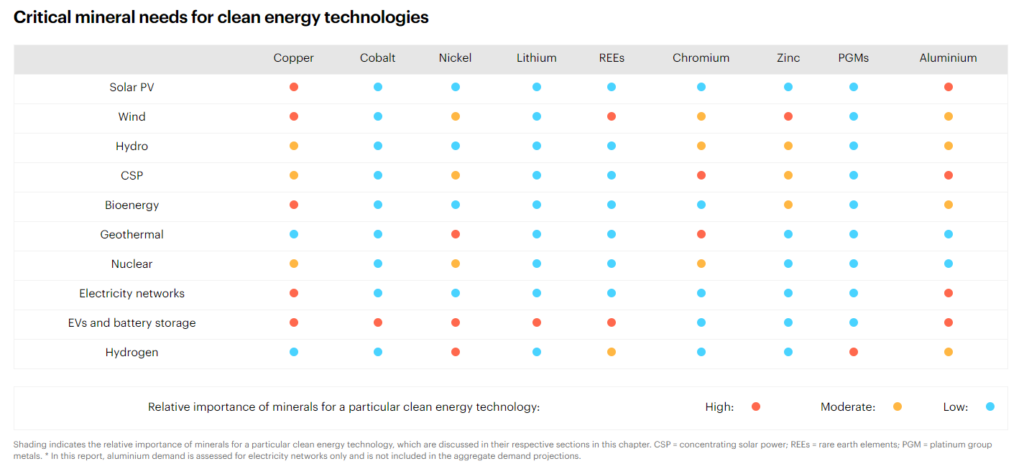

There’s been a lot of conversation about metals and mining this year, especially regarding the material inputs needed for climate technologies. Like other commodities, inflation, supply chain disruptions, and shifting demand across the world spiked metals prices this year.

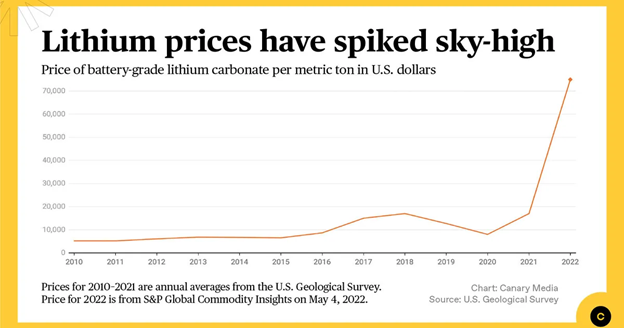

Lithium is a readily appreciable example. Lithium-ion batteries are a cornerstone of electrification. From EVs to home batteries and even utility-scale ones, it’d be nice if the world had an unlimited lithium supply that was easy to source. Unfortunately, that’s not the world we live in. And more lithium demand, especially for EVs, has driven price increases this year.

Still, these trends are becoming an oversized arrow in the quiver of folks who would have you think that efforts to wean off fossil fuels are doomed. I figured I’d take this newsletter to explore where those arguments miss the mark.

Metal misconceptions

The anti-climate tech crowd – whether outright climate change deniers or fossil fuel fanboys – loves to harp on the environmental costs of mining or metal supply shortages. Which, to be sure, are fair constraints and considerations. They also play well; post a picture of a mine on Twitter or talk about the extraction required for wind turbines or EV batteries, and you’ll score some likes.

Let’s dig in deeper, though. Copper is a good place to start. Needed for everything from electrical wiring to motors and more, people sometimes refer to it as “Dr. Copper.” It’s so integral to the world economy that some say you can ‘diagnose’ the state of the world’s economy by looking at what’s up with copper. While copper isn’t scarce, the extraction required for it isn’t great for the environment, as are the fossil fuels often used to prepare it for end-use in electrical applications.

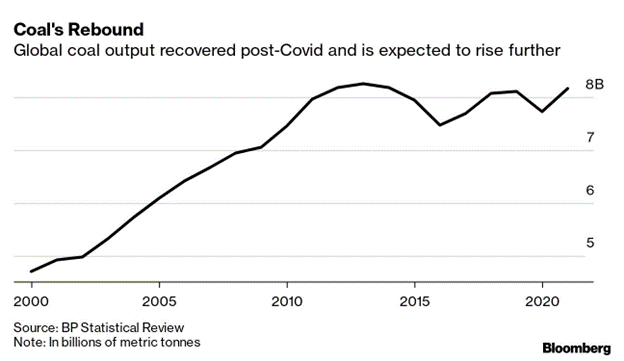

However, in terms of quantity extracted, the amount of coal and oil pulled from the Earth each year puts metals to shame. Specifically, ~400x more coal than copper is unearthed annually (8B metric tonnes vs. ~20M metric tonnes).

As a result, displacing coal demand with wind and solar can reduce material extraction, regardless of how much copper goes into a wind turbine or solar panel. There’s an old adage for commodities that says if you can’t grow it, you have to mine it. Which is true of most things, except, you know, energy from the wind and the sun.

A similar story holds for oil. The world produces north of 4B tonnes of oil annually, ~200x global copper production by weight.

No, oil and coal extraction aren’t apples to apples with metal mining intensity. Even high-grade copper deposits only ~2% copper in the surrounding earth and land. So you need to move a lot of Earth to source copper (more so than for oil or coal to be sure). Here’s a nice visualization of the amount of copper sourced from a mine if you rolled it into a shiny round orb:

Still, building EVs to displace gas miles with electric ones also reduces material extraction on balance. The lithium and other metals that go into an EV battery and the iron ore used to create the steel in its frame are one-time inputs. And over its life, a lightweight EV could displace ~8,000 gallons of gas if it’s on the road for 20 years and replaces a gas car (the average gas car uses ~400 gallons of gas annually on average in the U.S.).

That’s 400 barrels of oil, or ~50 tonnes (the car itself weighs 1-2 tonnes). Of course, driving less or not driving at all is even better if that’s your preferred climate solution. E-bikes are fantastic, as I was reminded of when I rode one over the Williamsburg bridge three nights ago. I digress.

Why am I reading this now?

Beyond comparing magnitudes, plenty of companies work on solutions to metals constraints. This year’s winner of TechCrunch disrupt is Minerva Lithium, a company focused on improving lithium extraction. Its product, Nano Mosaic, pulls lithium out of brine. Usually, lithium extraction requires evaporating brine or processing it in ‘ponds,’ which is less efficient.

And Minerva’s technology may be even more applicable for processes and manufacturing that have nothing to do with lithium. For instance, other chemical manufacturers often have lithium they wouldn’t process in excess brine. Desalination plants also produce waste brine that they’d be happy for someone else to process. Solutions like Minerva’s offer additional recovery and recycling for critical battery materials like lithium, augmenting total supply. I’ll see if we can get someone from the Minerva team on the podcast soon.

Elsewhere, one of the best-funded climate tech companies in the world, Redwood Materials ($792M in total funding), has a similar end-value proposition. Their business is recycling other technologies like EVs to recover as many metals as possible for re-use.

Suffice to say, plenty of folks are dialed in on the opportunity inherent to improving lithium extraction, or sourcing other important metals. And investors are taking note – earlier this week, U.S.-based Energy Exploration Technologies raised $450M from Global Emerging Markets for its end-to-end lithium extraction, production, and processing business (“brine to battery”).

There’s also a domestic push to reduce dependency on China for material inputs. China dominates the production and processing of critical metals, which poses a ‘material’ risk to U.S. businesses. Hence the $2.

The net-net

Yes, the fabric of society depends on things like mining metals out of the ground. But technologies like EVs and renewable energies are valuable because they reduce material extraction overall. And that doesn’t even address emissions or air pollution, which kills millions of people annually. No one argues that they don’t require extraction or denies that some of their inputs still depend on fossil fuels. They’re incremental improvements that reduce demand for the most extracted commodities in the world, including oil and coal.

For more on metals, we covered more about lithium and cobalt in this note, too.